Bernardo Federigi - 6 mars, 2023 - 6 ’ read

Bernardo Federigi - 6 mars, 2023 - 6 ’ readWhy you should choose Imagicle Conversational AI to empower your bank.

What’s the future of banking?

Banks are the reference point for a variety of crucial and delicate matters for their customers: it’s no surprise that the number of customer service requests they handle is outstanding. How many times have you heard people say they were frustrated with how a bank handled their issue? Maybe they had a problem with their account, couldn’t find their latest purchase in their list of movements, weren’t able to check their balance, etc. and your bank couldn’t deliver a prompt answer or resolution. Most likely, the reason fell under one of these case scenarios:

- The customer needed help at a time where the dedicated department was off work.

- The customer reached the wrong person, meaning they spoke to an employee that wasn’t adequately trained to answer for a number of reasons.

- Due to high number of requests your bank gets, you weren’t able to guarantee the promptness your customers expect and deserve.

These challenges, added to the current customer services trends, surely do call for an automation of customer service.

- Customers want to solve issues on their own, 24×7, through natural interactions. The classic call during office hours isn’t enough anymore.

- Customers want to use their preferred, often multiple, channels to communicate faster and easier. This especially concerns the youngest generation, which wants to avoid calling and interact on platforms such as WhatsApp, Messenger, Telegram, etc.

- However, 65% of people still prefer phone calls and to escalate to a human interaction for most valuable and critical issues.

So, how can your bank achieve top-quality customer service while introducing automation and omnichannel services?

The answer is Imagicle Conversational AI.

Imagicle Conversational AI for banks and finance. Elevate the banking experience.

Imagicle Conversational AI automates conversations through natural interactions and integrates chat and voice channels with virtual and human agents to improve customer and employee experience.

Every request is managed by a virtual assistant via voicebot or chatbot in real time with the option of transferring to an operator when needed. If you wish to learn more, you can read our Conversational AI blog post.

The use of platforms like Conversational AI is becoming increasingly common. According to Forbes, the need to improve digital services and employee experience leads 2023 to be “the year of Conversational AI” for banks, precisely because it brings automation and omnichannel features.

But while automation might be a more intuitive theme to address, because it’s easy to understand the benefits of having virtual assistants handle requests for you, what does omnichannel really mean?

The future of customer service is omnichannel.

As the name suggests, an omnichannel service offers multiple ways for customers to interact with you. This means that your bank will be able to assist customers on the classical phone, but also via new digital channels like WhatsApp, social media, Telegram, and more. It gives people the freedom of choosing which channel to contact your bank on, allowing them to feel more comfortable and at ease with solving their issue, thus improving fidelization. On the other hand, while they have multiple ways to reach you, you’ll have all your requests centralized in a single interface.

In the new era, customers have a frenetic life and they probably get in touch with you while travelling, commuting, even grocery shopping, and more. This means that they cannot always call you via phone but probably they would like to send you a message from the tools they’re used to have open on their phone.

Another aspect we need to care about is the type of request they have. In case they just need to know what time the bank opens, or get in touch with a low value information from you they are more likely to search on your website by sending a chat or getting in touch with you with the channels you provide. But let’s not forget that 65% of users still prefer phone calls, which means that the voice channel can’t be overlooked in favor of a digital approach. In fact, for more complex or important topics, they probably would like to speak with someone to better discuss deeper some details. This might be the case of discussing a change or upgrade in one’s banking account.

Thanks to the Imagicle Conversational AI, you can offer a full omnichannel experience and enable your operators to manage all the requests coming from all these channels (phone call, WhatsApp, Messenger, Telegram…) from a single interface, without changing tool, saving time. And, of course, the automation part allows you to let chatbots and voicebots be the first point of contact, only escalating to human operators if and when needed.

Indeed, in case of an escalation, by adding Imagicle Attendant Console, you can take care of incoming phone calls with the added value of professional features like parking, queueing, and more, and at the same time manage all the requests from the other channels that are addressed in a single chat integrated inside the console. A truely complete customer service solution, bringing together human and artificial intelligence, creating a win-win situation for both employees and customers.

Let’s go from theory to practice. What use cases do automation and omnichannel customer service cover in banking?

Credit & Debit card support.

Conversational AI instantly takes care of any issues customers may have with their credit & debit/ATM card. No more call queues, unavailable operators, or missing information – Conversational AI takes care of it all. Moreover, in case of human interaction, it will be able to suggest next best actions or similar use cases to help the operator handle the issue efficiently.

Check Balance.

Conversational AI automates end-to-end banking services: it allos customers to check account balances and transactions, view available funds, interests, and more in a quick, human-like interaction.

Alert set up.

Conversational AI is able to send a proactive alarm to the customer for important events such as balance/withdrawal, deposit, overdraft/over limit, payment due, vard purchase greater than 5X, and more.

How does Conversational AI work?

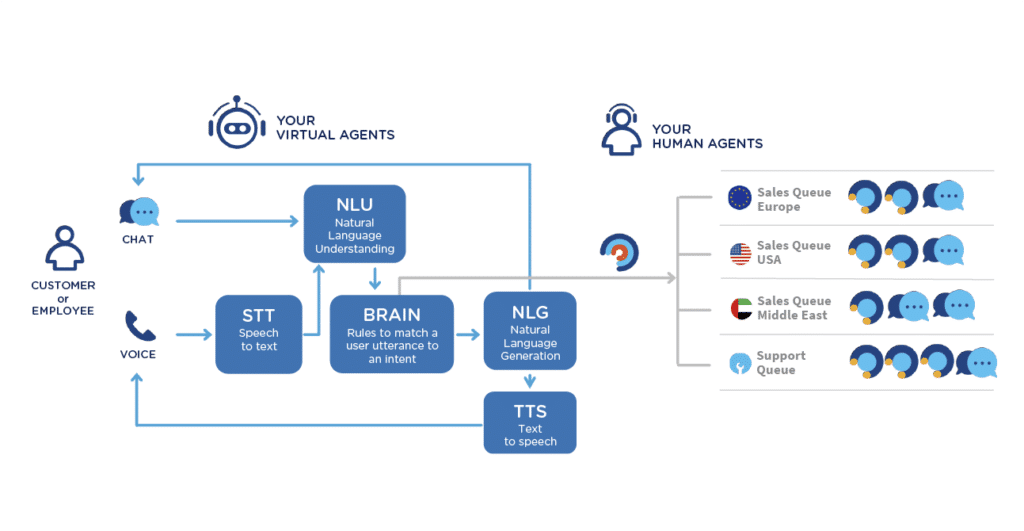

If you wish to know more on this topic, read here. To resume, take a look at the diagram below:

Language Understanding that leverages AI to understand what a piece of text means), then the “brain” of the system understands the true intent of the user.

At this point, thanks to NLG (Natural Language Generation), it responds adequately to the request.

If it is a voice request, the system works the same way, but, at the beginning of the process, an STT system (Speech to text) transforms the voice into text before passing it to the NLU. At the end of the process, a TTS (Text to speech) system is able to vocalize the response.

When the system’s brain realizes that the request is too complex or the caller wants a “human” interaction, the operator can intervene directly via chat or by telephone. In the second case, of course, the call can be addressed using our Advanced Queueing algorithms and managed by the operator through our amazing Imagicle Attendant Console.

A complete suite of apps. More than a simple platform.

Imagicle Conversational AI is just one of many apps inside the Imagicle UCX Cloud Suite – the complete set of UC apps available behind a single pane of glass to simplify deployment, administration, and use; enriched with AI/ML and conversational experiences to keep up with the new, more digital world.

By pairing Conversational AI with the other apps in the Suite, banks can reach a whole new level of automation, digital advancement, and productivity, in their work.

To give you some examples, Call Recording helps regulate disputes and retrieve information easily and compliantly. Call Analytics allows to stay on track with telephone budget by keeping track of it automatically across the organization, even in a hybrid work model. Attendant Console with Advanced Queueing and Auto Attendant allows a more organized and professional management and routing and calls, and so on.

Conclusions.

Market trends and customer needs speak loudly: people are not willing to wait to receive support or settle for a poor customer service. They expect to be served 24/7, with precision, through their favorite channel. Conversational AI helps you make customers happy and remove stress from employees, all this while cutting costs and improving productivity.

Don’t wait for the next complaint. Invest in Conversational AI today.

Vous pourriez également être intéressé par...

-

Products BlogDiscover the benefits of an AI virtual receptionist and learn how it works.Learn how AI virtual receptionists automate receptionist tasks, enhance customer service, and boost business efficiency.

-

Découvrez

Products BlogMeet Imagicle Virtual Receptionist, the digital twin of your human receptionists.Discover how you can bring your customer service to 10 without efforts. -

Products BlogNew Customer Service Analytics for Webex Calling Multi-Tenant.Explore Imagicle's new reports for Webex Calling, optimizing Customer Service with comprehensive call analytics.

Découvrez

Découvrez